Changes to IRS IP PIN Program:

What you need to know about the IRS IP PIN

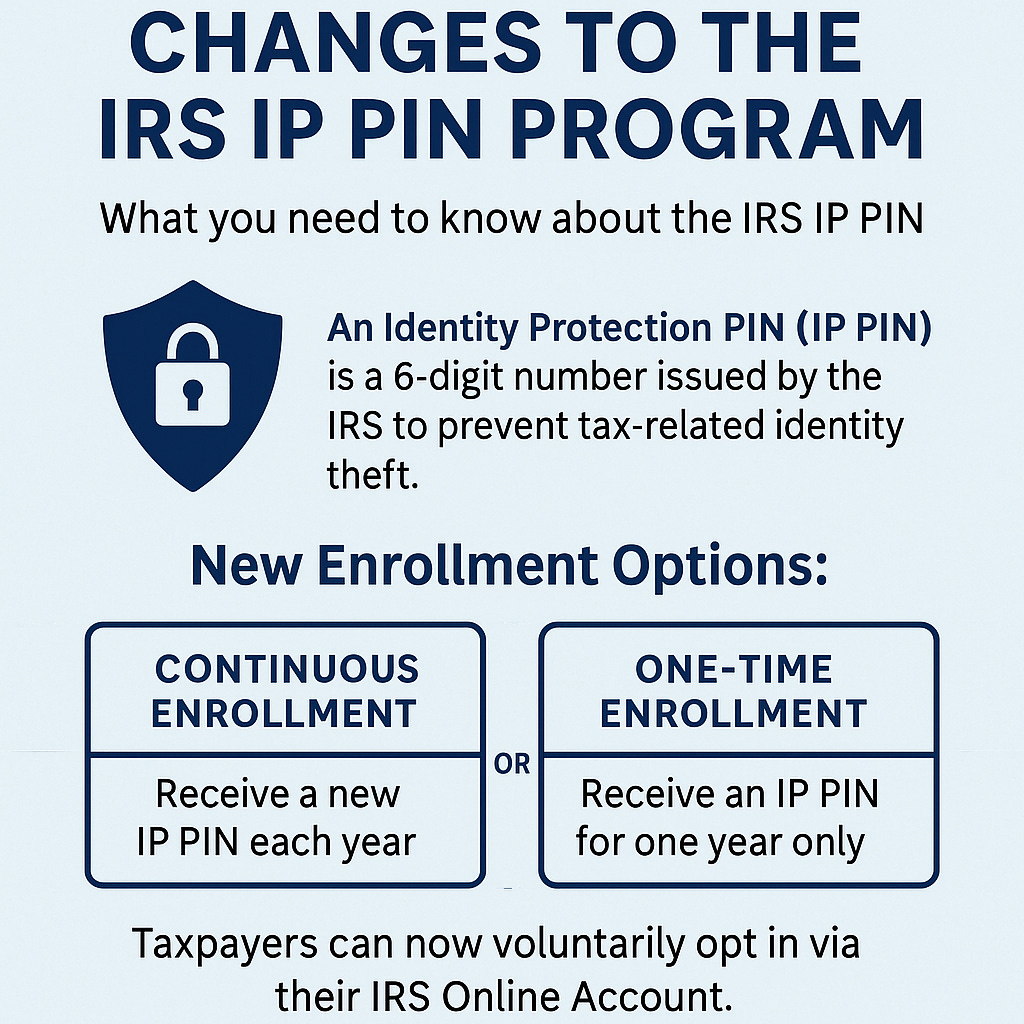

The IRS continues to make changes to taxpayers’ online individual account system, and one notable change involves the Identity Protection Personal Identification Number (IP PIN) program.

A taxpayer that has been the victim of identity theft or those looking to add a layer of protection to their tax filing, can now voluntarily opt into the IP PIN program with more flexibility than before.

🛡️ What Is an IP PIN?

An Identity Protection PIN (IP PIN) is a 6-digit number issued by the IRS to help protect against tax-related identity theft. It serves to authenticate the taxpayer when e-filing of their individual tax return.

The PIN is issued on an annual basis and must be reported on any tax returns filed during that year. For example, the PIN is issued in late December 2024 or early January 2025 via IRS notice CP01A. The IP PIN is entered on the 2024 form 1040 filed in 2025. If the taxpayer also has a prior year tax return that is being filed in 2025, the PIN is used to validate that tax return also.

📝 How to Get an IP PIN

Traditionally, taxpayers were enrolled in the IP PIN program after filing Form 14039 - Identity Theft Affidavit. This form was filed to report to the IRS that this specific taxpayer was the victim of tax-related identity theft. These taxpayers were enrolled for the IP PIN and continue to be issued annually.

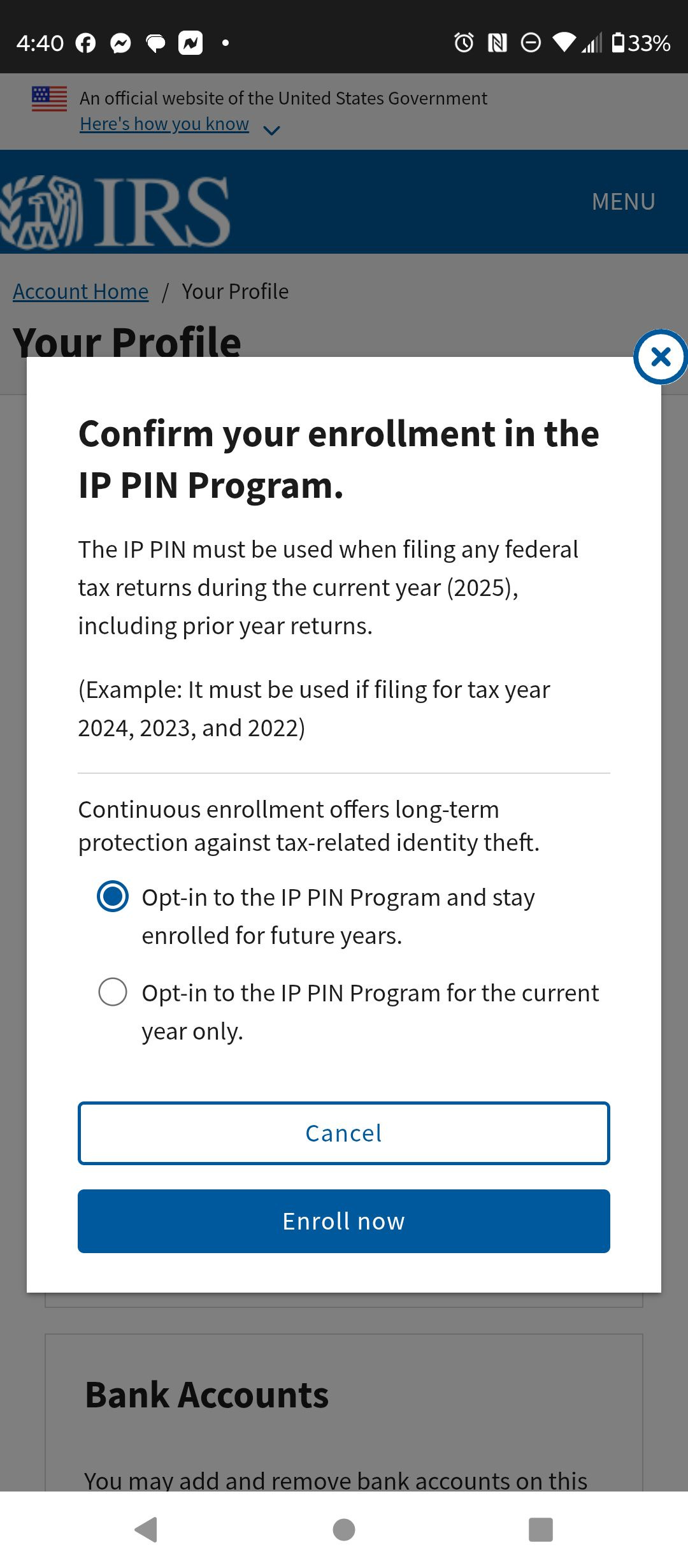

Now, however, taxpayers can voluntarily opt in to the IP PIN program through their IRS Online Account. Once logged in, they navigate to the Profile Tab, scroll to the bottom of that page, and enroll into the IP PIN Program. The taxpayer will be presented with two options when enrolling (see screen shot below):

1 - Continuous enrollment - enrolled for this year and for future years.

2 - One-time enrollment - enrolled for the current calendar year only; automatic unenrollment at the end of the calendar year.

If continuous enrollment is selected, the taxpayer can opt out by logging into their account and choosing that option later.

🔐 Why It Matters

The IP PIN program is a valuable tool for preventing fraudulent tax filings - and it’s now more flexible. The new one-year opt-in option gives taxpayers a chance to try the program without a long-term commitment.

However, it's important to note:

Voluntary enrollees can opt out later via their online account.

Victims of tax-related ID theft are indefinitely enrolled and cannot opt out through the online system.

✅ Final Thoughts

The ability to voluntarily opt into the IP PIN program—and choose between one-time or continuous enrollment—is a welcome improvement. But the distinction between the two options may be confusing for taxpayers and even for some tax professionals.

Have you enrolled for an IP PIN?

What are your thoughts on the new one-time option?

I’d love to hear your thoughts on the changes to the IP PIN opt in choices.