One Big Beautiful Bill (OB3): Tax Change Highlights

Quick Glance at the 2025 Tax Law Changes under HR 1

On July 4, 2025, the President signed into law the bill commonly referred to as the “One Big Beautiful Bill” Act, here after abbreviated as OB3. This legislation, first introduced in January 2025, went through several revisions before being finalized.

📄 To access the final text of the law, visit Congress.Gov Website - OB3 Bill Text and look for the version dated 7/1/2025, titled “Engrossed Amendment Senate”.

This article provides a high-level summary of several tax provisions. For more in-depth analysis, check out Tom Talks Taxes - a great resource for tax professionals and information on OB3.

❗ Misinformation Warning

Because OB3 had multiple evolving versions, there’s been a lot of confusion and incorrect claims circulating - particularly on social media. This article aims to communicate what’s actually in the law as of one week post-signing.

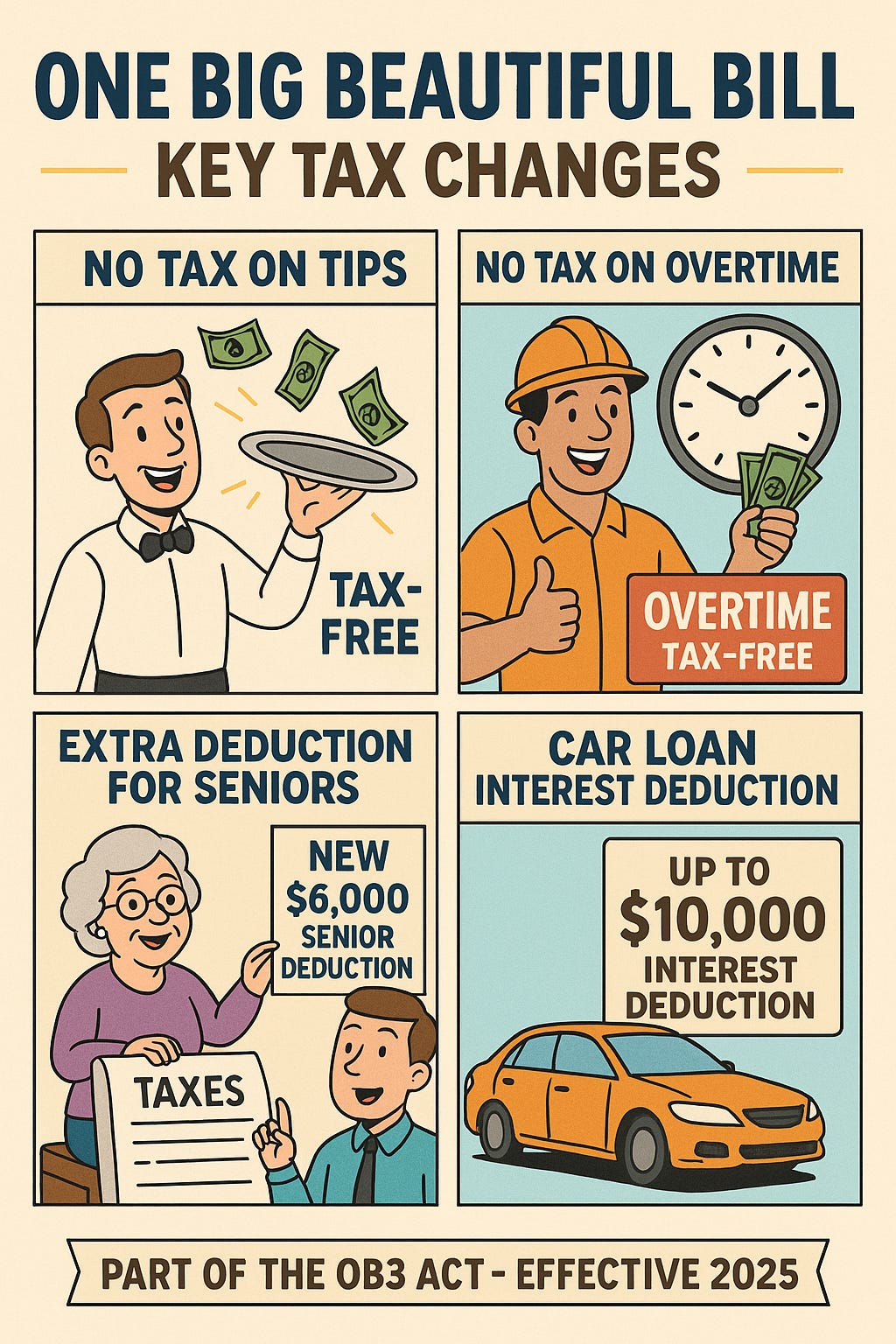

💵 No Tax on Tips (Sec. 70201)

Summary: A new deduction allows workers in typically tip-based industries to deduct up to $25,000 on the individual tax return for qualified tip income.

✅ Details:

Applies to cash tips (including tips paid by cards) for occupations where tipping was standard before 12/31/2024

Deduction is in addition to the standard or itemized deduction

Deduction phases out:

Starts at $150,000 single/$300,000 married

Fully phased out at $400,000 single/$550,000 married

Not allowed for married filing separate tax returns

Deduction allowed for tax years 2025 - 2028

Qualified tips required reporting on information returns - W-2s, 1099-NEC, 1099-K or reported by taxpayer on Form 4137

Available for self-employed individuals, but the tip deduction cannot exceed the net income from the business that the tips were received in connection with.

⏰ No Tax on Overtime (Sec. 70202)

Summary: Taxpayers will be able to deduct on their personal tax return the overtime premium portion of overtime wages received.

✅ Details:

The deduction amount is $12,500 single/$25,000 married

Phases out starting at $150,000 single/$300,000 married

Fully phased out at $275,000 single/$475,000 married

Must file a joint tax return, if married, to claim the deduction

Allowed for tax years 2025 - 2028.

👵 Extra Deduction for Seniors (Sec. 70103)

Summary: Taxpayers age 65+ may qualify to receive an additional $6,000 deduction.

✅ Details:

Applies per taxpayer (so $12,000 per couple if both are age 65 and up)

Separately allowed deduction, in addition to either standard or itemized deductions

Phases out at:

Single filing status: $75,000 - $175,000

Married filing status: $150,000 - $250,000

Must file a joint tax return, if married, to claim the deduction

Available for tax years 2025 - 2028.

🚗 Car Loan Interest Deduction (Sec. 70203)

Summary: Up to $10,000 of interest on loans for new qualified passenger vehicle loans is deductible.

Qualified Vehicle Criteria:

New car, minivan, van, SUV, pickup truck, or motorcycle

Gross vehicle weight rating of less than 14,000 pounds

Final assembly occurred within the United States

Purchased after 12/31/2024

This deduction phases out beginning at $100,000 single/$200,000 married, with full phase out at $150,000 single/$250,000 married

Available for tax years 2025 - 2028.

💡 This deduction is allowed even for non-itemizers.

🏛️ Other Notable Changes

❌ Elimination of Green Tax Credits

Electric Vehicle/Clean Vehicle credits: No available to vehicles purchased after 9/30/2025

Energy Efficient Home Improvement credit: Ends for property placed in service after 12/31/2025.

This credit is for improvements such as efficient windows and doors, insulation, and other similar improvements for energy efficiency purposes.

Residential Clean Energy credit: Ends for property placed in service after 12/31/2025. This credit covered items such as solar energy and other clean energy residential property.

🎲 Gambling Loss Limitation (Sec. 70114)

The law limits gambling losses to 90% of the amount of losses incurred, limited to the amount of gambling winnings, starting in years after 12/31/2025. This may create a taxable difference for taxpayers that are casual gamblers, despite overall net losses.

⚠️ Clients with gambling activity need proactive guidance to minimize negative impact from this change.

💵 State and Local Tax (SALT) Deduction (Sec. 70120)

New cap for 2025 is $40,000

Limitation based on income may reduce deduction to $10,000

📝 Final Thoughts

The OB3 Act contained provisions aimed at providing tangible tax relief for working- and middle-class Americans, while ending many green energy tax incentives. Expect guidance from the IRS in the coming months related to implementation and compliance with these changes.

If you’d like me to dive deeper into a specific provision, leave a comment or reply - I may cover that topic in a future article.